The IFMA President’s Conference, the premier event for top-to-top foodservice industry learning and exchange, is coming up again November 6-8. As a long time sponsor, we’re always looking to bring some innovation with us to Phoenix.

For 2016, we worked with IFMA to create an education series happening on Sunday afternoon before the main conference. Our presentation is about applying foodservice analytics to the growing Clean Food Movement.

At 4PM Sunday afternoon November 6th, I’ll introduce Lisa Fisher, VP of Sales for Chobani Foodservice. Tibersoft completed a ‘First Look’ live pilot for Lisa and her team providing a unified view of the channel: sales through distribution down to the operator locations. Lisa is going to talk about her company, her clean, premium products and why finding and sticking close to their operator customers is critical for profitable success.

Putting this event in the context of our broader mission, we see our role as helping clients find and keep customers profitably. Does this mission change with Clean Food? Yes, it intensifies it!

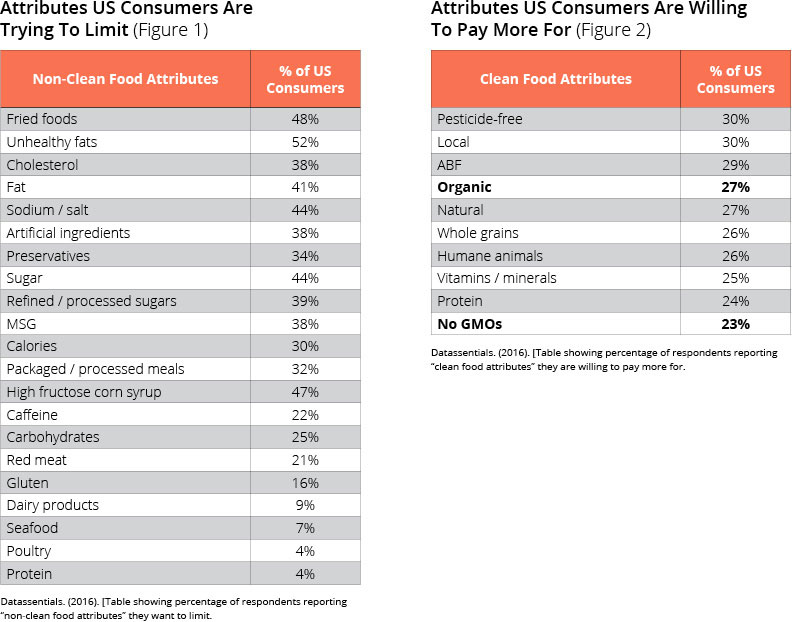

First let’s define what clean food is and check in on just how broad this movement has become. I reached out to Jack Li at Datassential for some stats. Their latest research says that 28% of US consumers are ACTIVELY seeking to include ‘clean label’ items into their diet. The chart below (figure 1) shows what these consumers are looking for.

Just as meaningful is the percentage of consumers willing to pay more (see figure 2). For example, 27 percent are willing to pay more for organic foods. Twenty-three percent are willing to pay for non-GMO foods. This seems to suggest that these consumers understand there is no free lunch—you either ‘pay the doctor or pay the farmer.’ Is this a transient fad? I don’t think so. You don’t suddenly reverse course and say ‘oh, I’ll buy dirty cheaper food, get sick, and see the doctor instead.’ This will most likely be a long-term trend.

As this trend continues to accelerate, what makes a Clean Food sales campaign different? Clean Food is a quality, not a price, argument. Market research clearly shows a growing number of people are looking for these products and, equally important, are willing to pay more.

THE CLEAN FOOD SALES CAMPAIGN CHECKLIST

R&D has created some clean food SKUs. Now what? This checklist includes important capabilities to support a successful migration to—or at least inclusion of—clean food.

Clean Item Catalog Attribute

Update your item catalog attributes to support easy finding, merchandizing and measuring of clean food items. Attributes are separate from Product Category trees. They help marketing choose a basket of items to sell to specific operator segments. They help sales find these items in their field support system, CRM, Explore, etc. Finally, post-campaign analysis will be easier with the ability to bucket clean items.

On–Demand Operator-Level Profitability

Create the ability to price waterfall any case sold at any time. This does not mean assembling a team of analysts to spreadsheet their way through the numbers for a few days and grind out a number. The cost and trade buckets should map and flow through systemically. Using this precise profitability measurement makes it easier to find likely clean food prospects willing to pay more and motivates sales with a higher close ratio.

Closed Opportunity Validation

The point at which all the sales work appears done is the point at which the process is most vulnerable. Last year, we surveyed 55 companies to find out how often closed-operator and GPO opportunities didn’t manifest into physical orders. The results showed that close to 90 percent of closed opportunities never materialized—and no one knew why. Your Clean Food portfolio will die on the vine if nine out of ten new opportunities disappear. This is where trade does more than just lock in a price point. The claims sell-through data provides visibility to the initial purchases.

Penetration Scoreboarding

So, when some cases are known to be flowing, do all the DCs have product? Are the expected locations purchasing? Are all the franchisees onboard? The use of the trade claims sell-through data now provides for on-going monitoring.

In our sales ‘casting’ model, this is Improve, Expand, and Defend. You have the business. The question is, do you have all of it, and are volume trends heading in the right direction?

The ability to monitor customer changes helps Chobani understand its customers, optimize profitability and better support operators who share its commitment to clean, natural products.

This is a huge topic and this blog post is certainly not trying to be the definitive word on the topic. So, if you’re going to IFMA PC, please come a little early and attend our session to find out more. I look forward to your feedback.

Click here to see all the session descriptions.