Foodservice deserves some good news:

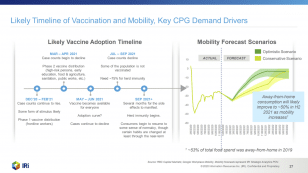

According to the most recent mobility report from Google, lagging segments could be in for a big second wind. For context, let’s take a look at IRI’s mobility forecast from late November:

How are we tracking? At first glance, it appears we’re walking the “Optimistic” trajectory: According to Google’s most recent mobility report, workplace mobility is down around -23% vs. baseline normal, compared to around -30% in February and nearly -45% during the first wave.

Sound like good news? We’re just getting started: workplace mobility is only one of 6 mobility categories that Google tracks. One category of significance, retail & recreation mobility, has surged from being down nearly 30% in February to only 8% on March 28th. In fact, at the segment level and overall, our team found this type of mobility to be more strongly correlated with total volume than workplace mobility – sometimes by a factor of 2 or more, and especially in some of the hardest-hit segments like hospitality, Full-Service Restaurants, and Colleges. In the strongest example, for every 1% increase toward the baseline in retail & recreation mobility, you can expect a 0.74% increase toward the baseline in hospitality volume. For independent FSRs, it’s 0.65%. All in all, segments with a volume and retail & recreation mobility coefficient of at least 0.45% make up 73.46% of contracted volume. While the pandemic has become known for shattering a hopeful signal or two, seeing such a dramatic change over the past month alongside many strong re-opening efforts is indeed fantastic news.

Interested in digging into the data yourself? Google has made their data available for the duration of the pandemic, and you can find it here. If you’d like some assistance, we’d be happy to share what we know – leave a comment down below and we’ll get back to you.